February 4, 2026 - 4 min read

Navigating the Crowded Surveillance Vendor Landscape

Chris Stapenhurst

Director, Product Management

The Market isn’t Chaotic. It’s Becoming a Risk in Itself.

The surveillance market is shifting fast. New vendors appear with bold claims, others fade out, and regulatory expectations keep climbing. The result is a landscape where the tools keep changing, while accountability only intensifies.

You still have to catch misconduct. You still have to prove control. And you still have to protect your firm from reputational and regulatory risk, regardless of how noisy the market becomes.

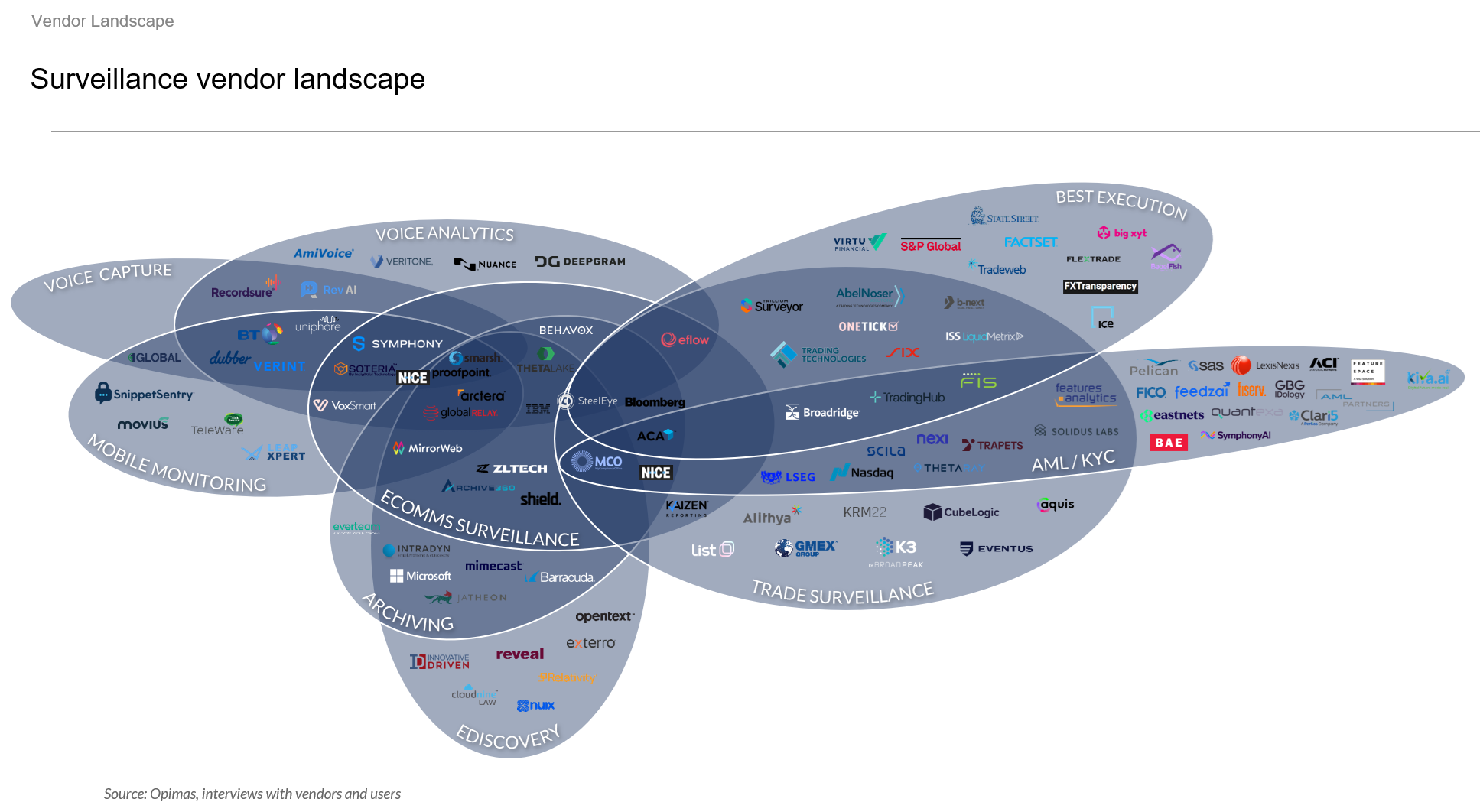

Independent Opimas research cuts through that noise. The vendor map doesn’t just show who is active. It reveals the forces reshaping surveillance, and the risks leaders need to anticipate next.

What the Technology Landscape Tells Us

1) The center of gravity has shifted toward communications surveillance.

This quadrant is the most crowded on the map, with new vendors and established players battling for differentiation. It reflects what FSIs already know: communication volumes are exploding, employee channels are expanding, and regulators still expect complete capture.

What to watch: AI-driven tools that lack clear explainability, governance, or audit readiness.

2) Archiving vendors are moving into surveillance, and surveillance vendors are moving into archiving.

Across the diagram, you see vendors drifting across category boundaries. Archivers now offer basic surveillance. Surveillance players are building archives. Everyone is fighting to own the data pipeline.

What to watch: When a vendor expands too quickly, execution gaps show up in implementations and support.

3) Hybrid deployment is becoming a differentiator, not a footnote.

The map highlights vendors repositioning themselves based on architecture. Some cloud-only players have lost traction. A handful of smaller vendors are now advertising on-prem options for the first time.

What to watch: Institutions using multi-region footprints will struggle with vendors who can’t support data residency or localized hosting.

4) AI maturity is uneven across categories.

Vendors clustered around communications and voice analytics are leaning heavily into NLP and LLM-driven features. Trade surveillance tools, by contrast, show slower adoption and more conservative roadmaps.

What to watch: FSIs adopting AI-powered tools without clear explanations for alerts or model behavior.

5) The landscape is crowded, but not in the same places.

Some areas of the map show intense overlap, particularly in communications, voice, and mobile. These are the areas where expectations are rising fastest and innovation pressure is highest, especially around AI-driven insight and conduct risk.

What to watch: Broad coverage claims that don’t translate into meaningful cross-channel insight in practice.

Why this matters

The vendor landscape doesn’t just reflect a growing market. It reflects a market under pressure–where expectations outpace capability, where category lines blur, and where FSIs must make technology decisions with long-term consequences.

Independent Opimas research confirms this. But the map itself tells a story every compliance and surveillance leader can see in plain sight: the stakes are rising, the choices are harder, and the landscape is moving beneath your feet.

"The surveillance market has outgrown its niche. It is now a pillar of operational resilience. The 2025 landscape shows competition shifting toward explainable AI, deployment flexibility, and data governance." — Anna Griem, Senior Analyst, Opimas, 2026

Arctera’s Point of View

We see the same landscape. And we see what FSIs are asking for.

Not more tools.

More clarity.

More control.

More technology that stands up to regulators, not just demos.

That’s why our platform focuses on:

- Accountable regulator-ready SaaS

- Transparent, explainable AI for regulator confidence

- Data governance by design for complete visibility

For financial institutions, detecting risk alone is no longer enough; proving it can be managed is what matters.

See the Big Picture. Join the Conversation.

Get the complete analysis in the Regulatory Outlook 2025–2027.

Then join us for our webinar on Thursday, February 19th, where we unpack the research and explore what it means for surveillance teams navigating the next regulatory wave.

- Download the "Financial Services Surveillance Regulatory Outlook" Report

- Register for the "2026 Compliance Lookahead: Implications for Surveillance Leadership" webinar